#1: Buying websites can go wrong

How I nearly lost $10.000 in buying a promising online magazine.

Hi there,

Buying websites and digital assets, in general, is becoming a thing. Websites such as Flippa, Empire Flippers are getting traction. In times of crisis, people look for alternative asset classes to invest in.

So you want to buy an online business?

Great, I do so, too.

Like thousands of other people out there. I don’t have any kind of private deal flow and therefore I browsed Flippa on a boring, rainy day. And here it was:

For SALE:

Website for sale in the Automotive industry ($10,000)

An online magazine for classic car enthusiasts.

Source: Flippa.com

What are your initial thoughts?

Let me share mine:

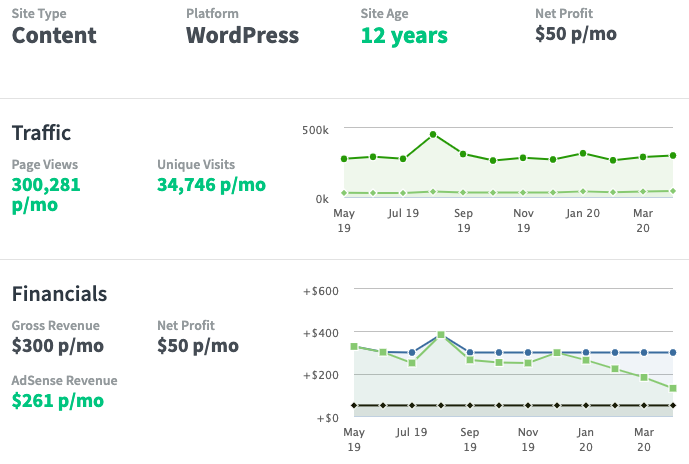

Nice niche — race cars, vintage cars, an affluent readership. And also the traffic is relatively good (approx. 35,000 people/month).

Undermonetized — yes, sure. The multiple is not great. At $50 net profit a month I need 200 months (approx. 16 years) to recoup my investment. However, the owner has maybe never tried to properly monetize it (i.e. just added Google Adsense).

Good content & SEO — well written, lengthy articles. According to Ahrefs.com a good backlink profile and overall well-aged content.

So my head went wild. I reached out to the owner just a few minutes later.

Where it gets interesting

I spare you the details of my subsequent due diligence. My hypothesis about the under-monetization was right. Have a look at the owner’s answer about monetization methods:

For the most part, we sold advertising direct to the companies that produced the events we covered. That would typically include a package of banner impressions and newsletter insertions. We kicked the tires with EBay and Afiliate marketing, but never really spent enough time on it. As we’ve spent less and less time on [name redacted], our revenue has morphed into 100% Adsense.

My hopes went up.

Is this indeed a potentially undervalued investment as it has tremendous growth opportunities (in addition to the technical errors I found when reviewing the website’s code, which are easy to fix)?

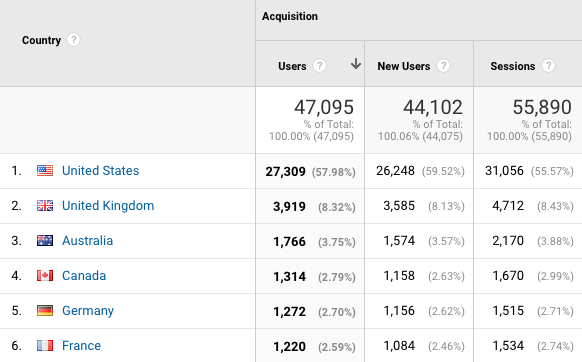

However, the Google Analytics access I requested was the most interesting detail of all.

Look what I found:

Source: Google Analytics, May 20 — Jun 18, 2020

So far, so good, right? So let’s dig a level deeper:

Source: Google Analytics, May 20 — Jun 18, 2020

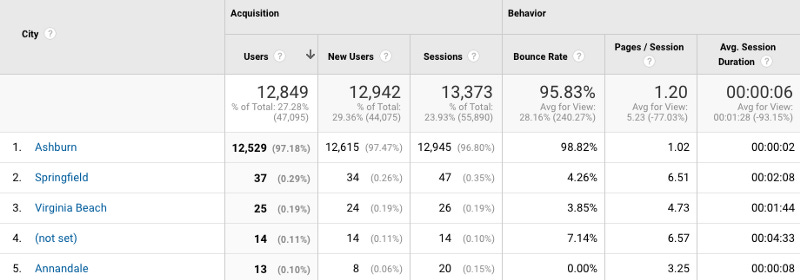

Hm, so many people from Virginia? Interesting.

And all of those people are from Ashburn? And they spend less than 2 seconds on the site, have a bounce rate of 98.82%?

Of the total of 47,095 visitors in the given time frame, 27% are from Ashburn and do not seem to care about the website?

DO YOU THINK THE SAME?

Yes, I do too. The numbers are inflated.

Even worse — either there is a bot at play or whatnot. Ah, and another nice thing: looking at the source code showed me that Google Analytics was embedded twice, by two different Wordpress plugins.

But let’s not get distracted.

Let’s look at the response of the owner:

Source: Flippa.com

WHERE’S ASHBURN?

I leave you to it. I am out.

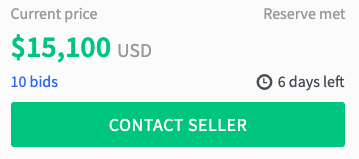

And do you know what’s best? The listing currently stands at 10 bids and counting.

I would never want to be one of them.

Source: Flippa.com

Until next time,

Alex

Thanks for showing how to do a due diligence on Flippa sites.

This was really insightful! Thanks for sharing. Looking forward to more specifics like these.